Welcome!

» Log In

» Create A New Profile

$$$$Any Speculation Why Gold & Silver Is Dropping?$$$$

Posted by jimmyjiver

This forum is currently read only. You can not log in or make any changes. This is a temporary situation.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 03, 2013 10:49PM |

Registered: 14 years ago Posts: 1,229 |

Egon von Greyerz....gotta hand it to this guy. He has been preaching getting your money out of the banking system for years now, and predicted at some point, somewhere, depositors at a bank were going to get fleeced. It may have taken awhile for it to happen, but it did.

At this point, with savings deposit interest at near zero, and the high probability that the bank you use is insolvent, it does make one think. At least the money under the mattress is liquid when the bank holidays take effect.

At this point, with savings deposit interest at near zero, and the high probability that the bank you use is insolvent, it does make one think. At least the money under the mattress is liquid when the bank holidays take effect.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 03, 2013 11:50PM |

Registered: 14 years ago Posts: 1,135 |

Now Johnson Mathey the largest seller of 100 oz silver bars in the US is sold out, and not even taking orders. They do not take orders if they are unsure of securing silver. Delivery on silver rounds and smaller bars are back ordered 4-5 weeks. I think people are waking up to the bank fraud that took place in Cyprus, and is rumored in other countries. At some point the price will explode upward. Protect yourself.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 04, 2013 09:56AM |

Registered: 13 years ago Posts: 1,445 |

ECB lowers interest rates to record low 0.5 percent [www.enetenglish.gr]

"The European Central Bank cuts interest rates to a new record low but has yet to come up with a way to help boost lending to small and medium-sized companies

The European Central Bank cut interest rates for the first time in 10 months on Thursday, driven to act by an economy wallowing in recession and freed to do so by sharply falling inflation.

The ECB lowered its main interest rate by a quarter point to a new record low of 0.50% in response to a drop in inflation well below its target level and rising unemployment."

Record Low interest rat and well, they have almost caught up to the US rate of .25%!

Can you smell the coffee?

Albert

ps - Very interesting, though not at all surprising, stories about silver production. That price has start to get moving here soon. I have a feeling it will be when the stock market starts to go... And it has a bit more upside then... boom!

"The European Central Bank cuts interest rates to a new record low but has yet to come up with a way to help boost lending to small and medium-sized companies

The European Central Bank cut interest rates for the first time in 10 months on Thursday, driven to act by an economy wallowing in recession and freed to do so by sharply falling inflation.

The ECB lowered its main interest rate by a quarter point to a new record low of 0.50% in response to a drop in inflation well below its target level and rising unemployment."

Record Low interest rat and well, they have almost caught up to the US rate of .25%!

Can you smell the coffee?

Albert

ps - Very interesting, though not at all surprising, stories about silver production. That price has start to get moving here soon. I have a feeling it will be when the stock market starts to go... And it has a bit more upside then... boom!

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 11, 2013 02:30AM |

Registered: 14 years ago Posts: 1,135 |

Bullion banks are finally going long gold.....price explosion is coming. The short hedge funds are about to have a religious experience.

Today whistleblower Andrew Maguire told King World News the perfect storm is brewing in the gold market as the LBMA and COMEX are collapsing. Maguire, who recently appeared in the extraordinary CBC production titled, “The Secret World of Gold,” also spoke with KWN about the disappearance of gold from both of those exchanges. Below is what Maguire had to say in part II of his remarkable written interview series which will be released today.

Maguire: “One thing is certain today, the bullion banks are on the long side of all of this selling. We are seeing cracks appearing in the fractional reserve LBMA and COMEX price setting mechanisms. It’s really thanks to the most recent paper market discount that we are evidencing this accelerated migration of bullion from the West to the East.

The more obvious this becomes, the more it exposes these bullion banks as holding real naked shorts that are absolutely undeliverable fractional reserve bullion positions....

“Fractional reserve bullion banking has now become so mismatched to the fundamentals that it’s going to be extinguished as the increased delivery demand forces this unwinding of the leverage.

This hot money (hedge fund money) is currently so short at unprecedented levels, while the bullion banks are taking the long side of this fresh short supply that’s coming in from weak hands. This short fuel above the market is actually a tinder box ready to ignite, and it has set up the current driver for the next move.

The COMEX inventories have been steadily drained, but it’s accelerated rapidly over the last three months. These mismatched leases are forced to be extended now beyond any historical extremes that I can ever recall, and I talk to other people in the wholesale market and we are all seeing this crack in the system. On April 12th we saw official defense come in (to the gold market) and it was to avert this imminent LBMA bullion bank default. But it was just the way it was executed. It was grossly misjudged.

And even though this activity (intervention) bought a little more time for these guys, the immediate and unanticipated but accelerated bullion demand (all over the world), actually ended up digging an even deeper hole for the Fed, the Bank for International Settlements (BIS), and the agent bullion banks. They have actually shot themselves in the foot.

By simply tracking the movements in the international wholesale market, it’s clear that a major supply problem is brewing. Where has this bullion gone? It is clearly Fed and Bank for International Settlements borrowed bullion. What they are doing is seeking to avert a fractional reserve delivery default. These are in the price setting centers of London and the COMEX. And it is further extenuated by arbitragers who are moving bullion out of the COMEX and reselling it at higher, real global prices.

So you have a perfect storm here. This (Western gold) bullion is not coming back. It’s being re-melted, cast into kilobars, and it’s ending up directly in Eastern hemisphere central bank and sovereign vaults. And all of this time the bullion banks are calling for lower prices, and the mainstream media is touting a bear market. The bullion banks are fully aware of this threat, and they are exiting these mismatched short positions.”

© 2013 by King World News®.

Today whistleblower Andrew Maguire told King World News the perfect storm is brewing in the gold market as the LBMA and COMEX are collapsing. Maguire, who recently appeared in the extraordinary CBC production titled, “The Secret World of Gold,” also spoke with KWN about the disappearance of gold from both of those exchanges. Below is what Maguire had to say in part II of his remarkable written interview series which will be released today.

Maguire: “One thing is certain today, the bullion banks are on the long side of all of this selling. We are seeing cracks appearing in the fractional reserve LBMA and COMEX price setting mechanisms. It’s really thanks to the most recent paper market discount that we are evidencing this accelerated migration of bullion from the West to the East.

The more obvious this becomes, the more it exposes these bullion banks as holding real naked shorts that are absolutely undeliverable fractional reserve bullion positions....

“Fractional reserve bullion banking has now become so mismatched to the fundamentals that it’s going to be extinguished as the increased delivery demand forces this unwinding of the leverage.

This hot money (hedge fund money) is currently so short at unprecedented levels, while the bullion banks are taking the long side of this fresh short supply that’s coming in from weak hands. This short fuel above the market is actually a tinder box ready to ignite, and it has set up the current driver for the next move.

The COMEX inventories have been steadily drained, but it’s accelerated rapidly over the last three months. These mismatched leases are forced to be extended now beyond any historical extremes that I can ever recall, and I talk to other people in the wholesale market and we are all seeing this crack in the system. On April 12th we saw official defense come in (to the gold market) and it was to avert this imminent LBMA bullion bank default. But it was just the way it was executed. It was grossly misjudged.

And even though this activity (intervention) bought a little more time for these guys, the immediate and unanticipated but accelerated bullion demand (all over the world), actually ended up digging an even deeper hole for the Fed, the Bank for International Settlements (BIS), and the agent bullion banks. They have actually shot themselves in the foot.

By simply tracking the movements in the international wholesale market, it’s clear that a major supply problem is brewing. Where has this bullion gone? It is clearly Fed and Bank for International Settlements borrowed bullion. What they are doing is seeking to avert a fractional reserve delivery default. These are in the price setting centers of London and the COMEX. And it is further extenuated by arbitragers who are moving bullion out of the COMEX and reselling it at higher, real global prices.

So you have a perfect storm here. This (Western gold) bullion is not coming back. It’s being re-melted, cast into kilobars, and it’s ending up directly in Eastern hemisphere central bank and sovereign vaults. And all of this time the bullion banks are calling for lower prices, and the mainstream media is touting a bear market. The bullion banks are fully aware of this threat, and they are exiting these mismatched short positions.”

© 2013 by King World News®.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 11, 2013 11:58AM |

Registered: 15 years ago Posts: 1,852 |

Possum, I hope some of the readers here have shelled out some good 'ole US greenbacks to subscribe to the premium conspiracy channels on King World News. Your commission check will be in the mail next week.

Now back to the real economy: "S&P 500 ends at record for fifth day"

[www.reuters.com]

Now back to the real economy: "S&P 500 ends at record for fifth day"

[www.reuters.com]

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 11, 2013 01:45PM |

Registered: 14 years ago Posts: 1,135 |

Hey Go rebs, I realize you and me are on different ends of the investment spectrum. Thats ok. Do what you feel comfortable with. I have been following King News for years, and those guys are quite accurate on average, though their timing can be off. Its hard to predict manipulated markets, short term. I hope you notice that the big banks are shifting their short metals positions, onto the hedge funds, and going long. The big boys have a fair amount of control in the markets. By them taking on long positions, the price will move in their favor at some point, in a big way. The big boys seldom lose big. The next few years will be interesting. If I received commish checks, Id gladly send some your way.

You are correct on Finds forums. It seems they have lost alot of posters over the last few years.

Now rebs, get out there and detect some of those precious metals! HH

You are correct on Finds forums. It seems they have lost alot of posters over the last few years.

Now rebs, get out there and detect some of those precious metals! HH

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 11, 2013 08:17PM |

Registered: 14 years ago Posts: 1,229 |

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 12, 2013 05:36PM |

Registered: 13 years ago Posts: 1,445 |

Dow 15,000: Don’t Fight the Fed, But Be Afraid [business.time.com]

Some notable quotes for those confused by things:

The Fed is on track to purchase $85 billion worth of assets each month for the rest of this year, and “QE3” as this third round of Fed ammo is called may last even longer than that, given the latest jobs report.

But how afraid should we be? And how soon? That’s the magic question. Almost no investor I know thinks that the Fed hasn’t played a large if not definitive factor in the record Dow numbers. After all, when the return on a T-bill is basically flat, and a return on European sovereign debt is negative, where else can you put your money but in a good blue chip stock paying a 3% dividend. But at some point, everyone knows the music will stop. Then, the risks are myriad – stock bubbles may burst, the Fed’s exit from QE3 could become messy, inflation could rise sharply, or we could see some kind of systemic financial instability.

But what’s bad for the real economy is—or at least has been–good for stocks. As I’ve explained before, the disconnect between underlying economic data and record stock prices is largely down to the Fed and its firepower. It’s worth noting that each round of QE has slightly less of an effect on the markets than the one before.

But it’s worth remembering that when there’s a disconnect between the real economy and the markets, it never lasts forever. Ultimately, if stocks are to stay up, corporate profits and consumer spending have to improve as well. And those factors are ultimately buoyed by real economic growth – not the Fed.

Check out the whole article if you doubt the stock market is not an indicator of economic health, etc.

My guess, as mentioned before is the the DOW to near 16000 and then a crash and huge rise in Gold/Silver Prices. May not get to 16000 but I bet the latter part does. Interesting that the banks are long gold again, telling. 10, 9, 8, 7, 6...

Albert

Some notable quotes for those confused by things:

The Fed is on track to purchase $85 billion worth of assets each month for the rest of this year, and “QE3” as this third round of Fed ammo is called may last even longer than that, given the latest jobs report.

But how afraid should we be? And how soon? That’s the magic question. Almost no investor I know thinks that the Fed hasn’t played a large if not definitive factor in the record Dow numbers. After all, when the return on a T-bill is basically flat, and a return on European sovereign debt is negative, where else can you put your money but in a good blue chip stock paying a 3% dividend. But at some point, everyone knows the music will stop. Then, the risks are myriad – stock bubbles may burst, the Fed’s exit from QE3 could become messy, inflation could rise sharply, or we could see some kind of systemic financial instability.

But what’s bad for the real economy is—or at least has been–good for stocks. As I’ve explained before, the disconnect between underlying economic data and record stock prices is largely down to the Fed and its firepower. It’s worth noting that each round of QE has slightly less of an effect on the markets than the one before.

But it’s worth remembering that when there’s a disconnect between the real economy and the markets, it never lasts forever. Ultimately, if stocks are to stay up, corporate profits and consumer spending have to improve as well. And those factors are ultimately buoyed by real economic growth – not the Fed.

Check out the whole article if you doubt the stock market is not an indicator of economic health, etc.

My guess, as mentioned before is the the DOW to near 16000 and then a crash and huge rise in Gold/Silver Prices. May not get to 16000 but I bet the latter part does. Interesting that the banks are long gold again, telling. 10, 9, 8, 7, 6...

Albert

|

Gold Falls Below $1400... again May 17, 2013 01:18PM |

Registered: 15 years ago Posts: 1,852 |

[money.msn.com]

The Fed is doing exactly as it should, stimulating the economy while minimizing the risk of inflation.

The Fed is doing exactly as it should, stimulating the economy while minimizing the risk of inflation.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 17, 2013 01:50PM |

Registered: 15 years ago Posts: 57 |

^^^Do you work for the Federal Reserve?

In 1968, one could buy a double eagle for $80 US. Today, one will cost you around $1700 US.

How is that for minimizing inflation?

You can't argue with the above, as it's reality. Printing money as fast as you can get the paper to do it on, NEVER minimizes inflation. Those who who don't follow history, are doomed to repeat it...

In 1968, one could buy a double eagle for $80 US. Today, one will cost you around $1700 US.

How is that for minimizing inflation?

You can't argue with the above, as it's reality. Printing money as fast as you can get the paper to do it on, NEVER minimizes inflation. Those who who don't follow history, are doomed to repeat it...

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 17, 2013 02:18PM |

Registered: 15 years ago Posts: 1,852 |

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 17, 2013 02:53PM |

Registered: 15 years ago Posts: 57 |

go-rebels Wrote:

-------------------------------------------------------

> > Do you work for the Federal Reserve?

>

>

> No -

>

> The scope of the original question relates to the

> 'near term', not the past 45 years.

If you want to make a quick buck, physical gold is probably not the answer. If you want to keep the value of your money, then buying physical gold is about as risk free as it gets.

Gold at $1100 oz. or less in todays world is a steal. $1300 oz. is still not too bad of a price. Beats holding worthless paper.

-------------------------------------------------------

> > Do you work for the Federal Reserve?

>

>

> No -

>

> The scope of the original question relates to the

> 'near term', not the past 45 years.

If you want to make a quick buck, physical gold is probably not the answer. If you want to keep the value of your money, then buying physical gold is about as risk free as it gets.

Gold at $1100 oz. or less in todays world is a steal. $1300 oz. is still not too bad of a price. Beats holding worthless paper.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 17, 2013 02:53PM |

Registered: 15 years ago Posts: 57 |

If you want to make a quick buck, physical gold is probably not the answer. If you want to keep the value of your money, then buying physical gold is about as risk free as it gets.

Gold at $1100 oz. or less in todays world is a steal. $1300 oz. is still not too bad of a price. Beats holding worthless paper.

Gold at $1100 oz. or less in todays world is a steal. $1300 oz. is still not too bad of a price. Beats holding worthless paper.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 17, 2013 03:37PM |

Registered: 14 years ago Posts: 1,229 |

The problem with inflation is how it is measured. Just like 'creative accounting', it all depends on how the government calculates it. Since the CPI is used in a lot of calculations and numbers that 'mean something', it is beneficial to make that number as good as it can be when related to the specific calculation.

Reminds me of the joke about several people interviewing for a job at a financial institution. The interviewer asks the simple quesiton ' What is 1 + 1". The first several applicants answer '2'. The interviwer thanks them for their time. The last applicant is asked the same question. His/her anwer is ' What do you want it to be ? ' The interviewer then states ' You are hired...when can you start'

The CPI basket is rigged. The real measure of inflation is what it is doing to you,specifically. If you have any children, then you are affected a lot more than others that do not. The cost of food ( well, the cost can be the same, but portion sizes have shrunk 15-25%...which is one of the tactics to keep the CPI stable !!) , health care and tuition costs FAR exceed the fake 3-4% the government spews upon us.

Back to the original question. At this point, big players holding ETP's and paper contracts are bailing. The paper price is falling due to that, and the fake government numbers. The numbers make is seem like we are in a recovery, which is far from the truth.

The diametrially opposed physical market is continuning to trend higher as inventories shrink in the vaults, and more retail buyers snatch up physcial gold and silver bullion. What they will tell you is that the May numbers are lower than the April numbers. Well, April was a stellar month. There has to be some let up.

Only a matter of time...but time can be measured in numerous ways....seconds, hours, days, weeks, years.....etc. !

Reminds me of the joke about several people interviewing for a job at a financial institution. The interviewer asks the simple quesiton ' What is 1 + 1". The first several applicants answer '2'. The interviwer thanks them for their time. The last applicant is asked the same question. His/her anwer is ' What do you want it to be ? ' The interviewer then states ' You are hired...when can you start'

The CPI basket is rigged. The real measure of inflation is what it is doing to you,specifically. If you have any children, then you are affected a lot more than others that do not. The cost of food ( well, the cost can be the same, but portion sizes have shrunk 15-25%...which is one of the tactics to keep the CPI stable !!) , health care and tuition costs FAR exceed the fake 3-4% the government spews upon us.

Back to the original question. At this point, big players holding ETP's and paper contracts are bailing. The paper price is falling due to that, and the fake government numbers. The numbers make is seem like we are in a recovery, which is far from the truth.

The diametrially opposed physical market is continuning to trend higher as inventories shrink in the vaults, and more retail buyers snatch up physcial gold and silver bullion. What they will tell you is that the May numbers are lower than the April numbers. Well, April was a stellar month. There has to be some let up.

Only a matter of time...but time can be measured in numerous ways....seconds, hours, days, weeks, years.....etc. !

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 17, 2013 09:40PM |

Registered: 14 years ago Posts: 1,135 |

John Williams from Shadowstats uses the old methods for figuring the inflation rate. He says its close to 9.5% a year.

With all the money printing going on, at somepoint inflation will launch upwards. Your buying power will take a major hit.

That will not be fun. The good news will be your closet full of detectors will go up in value.

Seriously, keep an eye on the crude oil prices and interest rates. Those will be 2 indicators ( of many) to watch.

With all the money printing going on, at somepoint inflation will launch upwards. Your buying power will take a major hit.

That will not be fun. The good news will be your closet full of detectors will go up in value.

Seriously, keep an eye on the crude oil prices and interest rates. Those will be 2 indicators ( of many) to watch.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 17, 2013 10:28PM |

Registered: 15 years ago Posts: 1,852 |

The Core CPI, the one most often stated in the press, has remained unchanged for forty years. There is no partisan manipulation there. The Bureau of Labor Statistics maintains hundreds of indices for your study. Pick your poison.

It is a troubling time to see the buy/sell spread of physical gold today. The best internet dealers have a $70 spread @ $1359/oz: $1339 to buy, $1409 to sell. $70 = 5%; that's a terrible spread in any investment field. And that's as good ad it gets; your local gold dealer will charge a steeper commission... on both ends.

---

Shadowstats reminds me of www.unskewedpolls.com that was often referenced by Fox News during the 2012 presidential election. I wonder what ever came of them?

It is a troubling time to see the buy/sell spread of physical gold today. The best internet dealers have a $70 spread @ $1359/oz: $1339 to buy, $1409 to sell. $70 = 5%; that's a terrible spread in any investment field. And that's as good ad it gets; your local gold dealer will charge a steeper commission... on both ends.

---

Shadowstats reminds me of www.unskewedpolls.com that was often referenced by Fox News during the 2012 presidential election. I wonder what ever came of them?

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 18, 2013 12:25AM |

Registered: 14 years ago Posts: 1,229 |

go-rebels Wrote:

-------------------------------------------------------

> The Core CPI, the one most often stated in the

> press, has remained unchanged for forty years.

> There is no partisan manipulation there.

>

WHAT ?

There are rules made that they can swap out goods, use substitution, packaging, not include certain items that every day MIDDLE CLASS Americans use and save for ( fuel, health care, tuition). The CPI is hooked into the COLA for SS benefits ( if they used the TRUE inflation rate, they could never give the corresponding cost of living adjustments). It is hooked into a lot of other calculations, so for sure it is manipulated. The core CPI has not changed because they can mess with it to make it stay horizontal as long as they want to.

So I guess you are correct. If you make up the rules and change them when needed, it really does not count as manipulation since you are playing by the rules.

As far as the spread or premium goes, it goes up when demand goes up. What commodity has it's price ( sorry, FAKE PRICE) decrease, yet it's demand INCREASE ( in terms of REAL PHYSICAL GOLD/SILVER) ? Think about that.

A lot people put physical gold/silver buying into the same bucket as stock investing or trading and watch the paper markets and the futures markets. That can be a basis for how they think, but it is the wrong assumption when applying it to physical bullion.

Some people who buy physical gold/silver bullion do it as a LONG TERM investment strategy as part of an overall portfolio. I am one of them. For me it is a hedge against the dollar that continues to get printed into oblivion. It is also to preserve some of my purchasing power in the future if inflation really gets bad. At this point I have no idea how the Fed is going to unwind, so my bet is they juice up even more to 120-150 Billion per month.

There are others who put their entire lot into the physical as they feel this is the safest bet for THEM, and they like having the investment in their possession. Can't argue with that following some of the crazy stuff happening out there.

Bottom line is, all investment vehicles hit lows and highs. A lot more people are looking at the correction ( notice how the MSM continues to bash the correction as a bear market), as a buying opportunity. It is also at this point a contrarian play. Did you EVER hear the MSM talking heads say sell stocks and buy gold....even when it was going up over that bull cycle ? NOPE. Why...because they don't make any money when a person walks into their LCS and plunks down some fiat for a nice shiny object they can hold.

Just do me a favor go-reb and be careful out there. Don't chase that extra 1-2 % and take some off the table. There will be a correction in the market soon. Me, I rather be 5 steps ahead and on the sidelines when it happens, than trying to get out when all the big boys start pushing the button and all the stops get triggered. I am parked in cash now for most of my money. Still have some in the market, but at this point probably only 10-15%.

But every pay day I do buy me a nice 10 ounce bar of silver ! HA !

-------------------------------------------------------

> The Core CPI, the one most often stated in the

> press, has remained unchanged for forty years.

> There is no partisan manipulation there.

>

WHAT ?

There are rules made that they can swap out goods, use substitution, packaging, not include certain items that every day MIDDLE CLASS Americans use and save for ( fuel, health care, tuition). The CPI is hooked into the COLA for SS benefits ( if they used the TRUE inflation rate, they could never give the corresponding cost of living adjustments). It is hooked into a lot of other calculations, so for sure it is manipulated. The core CPI has not changed because they can mess with it to make it stay horizontal as long as they want to.

So I guess you are correct. If you make up the rules and change them when needed, it really does not count as manipulation since you are playing by the rules.

As far as the spread or premium goes, it goes up when demand goes up. What commodity has it's price ( sorry, FAKE PRICE) decrease, yet it's demand INCREASE ( in terms of REAL PHYSICAL GOLD/SILVER) ? Think about that.

A lot people put physical gold/silver buying into the same bucket as stock investing or trading and watch the paper markets and the futures markets. That can be a basis for how they think, but it is the wrong assumption when applying it to physical bullion.

Some people who buy physical gold/silver bullion do it as a LONG TERM investment strategy as part of an overall portfolio. I am one of them. For me it is a hedge against the dollar that continues to get printed into oblivion. It is also to preserve some of my purchasing power in the future if inflation really gets bad. At this point I have no idea how the Fed is going to unwind, so my bet is they juice up even more to 120-150 Billion per month.

There are others who put their entire lot into the physical as they feel this is the safest bet for THEM, and they like having the investment in their possession. Can't argue with that following some of the crazy stuff happening out there.

Bottom line is, all investment vehicles hit lows and highs. A lot more people are looking at the correction ( notice how the MSM continues to bash the correction as a bear market), as a buying opportunity. It is also at this point a contrarian play. Did you EVER hear the MSM talking heads say sell stocks and buy gold....even when it was going up over that bull cycle ? NOPE. Why...because they don't make any money when a person walks into their LCS and plunks down some fiat for a nice shiny object they can hold.

Just do me a favor go-reb and be careful out there. Don't chase that extra 1-2 % and take some off the table. There will be a correction in the market soon. Me, I rather be 5 steps ahead and on the sidelines when it happens, than trying to get out when all the big boys start pushing the button and all the stops get triggered. I am parked in cash now for most of my money. Still have some in the market, but at this point probably only 10-15%.

But every pay day I do buy me a nice 10 ounce bar of silver ! HA !

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 18, 2013 03:24AM |

Registered: 15 years ago Posts: 1,852 |

Rover, there are thousands of items in the Core CPI broken down into (7) major expenditure groups, (69) expenditure classes per group and (184) items per class. Every ~10 years or so items are reviewed so, for example, in 1985 record players may have been removed and portable cassette decks added. The Core CPI has risen steadily over decades, as expected. If you don't like the Core CPI, pick another. If you don't like how a particular CPI affects SS benefits, vote out your current politician. I don't have a dog in the fight; i just find your paranoia a bit over-the-top.

I like your balanced approach to investing. We just have different proportions.

The "Fed" and Central Banking seem to be a common thread here and the drop in gold/silver can, in part, be attributed to Fed policy and the resultant low inflation rate. The Wall Street Journal had a good, easy-to-read article this past Wednesday:

WSJ Global Economics Editor David Wessel joins the News Hub with a look at what we know and what we don't know about central banks, easy money, asset purchases and bubbles.

The Dow Jones Industrial Average has risen 14% since the Federal Reserve launched a third round of bond buying in September.

The Stoxx Europe 600 index has climbed 22% since the president of the European Central Bank vowed in July to do "whatever it takes" to save the euro.

Japan's Nikkei has risen 22% since the Bank of Japan unveiled its big bond-buying initiative in April—and more than 50% since the election of a new government that campaigned on installing an aggressive central banker.

There were, of course, other drivers behind the stock-market gains. But there's little doubt that when central banks print lots of money (or hint they will), they push up stocks, bonds, houses and other assets. Indeed, that was part of the plan: Boost asset prices so businesses and consumers will spend more readily.

Did the central banks' efforts work? Did struggling economies get a lift? And has the Fed, which acted more forcefully than others, overdone it? Is it blowing another bubble already?

Taking the Fed as a case study, the short answers: Yes, it worked, though not as well as anyone hoped. And, no, the Fed hasn't overdone it yet, but that's worth worrying about.

There is plenty to criticize about the Bush-Obama-Bernanke response to the financial crisis and recession, but consider this: The combined one-two punch of fiscal and monetary policies has helped the U.S. economy expand for the past 20 quarters. Europe, which did less fiscal and less monetary stimulus, is mired in its second recession in a decade; its economy has been contracting for six quarters.

The Fed's moves to push mortgage rates down are helping home prices—and, lately, home building. And, at last, there are signs that rising stock and bond prices are doing more than helping companies refinance old debt and fattening rich Americans' brokerage accounts: A surge in initial public offerings is giving growing companies capital to expand. The strength of consumer spending despite stagnant wages reflects, in part, rising stock and house prices.

But … we know what can happen when rates are too low for too long and credit is too readily available: People and businesses borrow too much for their own good. Banks get into trouble. Investors unhappy with low yields on bank deposits or Treasury bonds look for higher returns in riskier assets, not always understanding the potential downside. Money seeps into poorly regulated crevices of the financial system like water that seeps into cracks in cliffs, then freezes, expands and causes a rock slide.

It's such memories that lead some thoughtful people who applauded the initial round of Fed bond buying to suggest the latest round was too much. They see the rapid growth of companies that rely on low short-term rates to borrow heavily, buy mortgages and pay big dividends. They see investors buying junk bonds at low rates at which only the U.S. Treasury could borrow not so long ago. They see small investors borrowing to buy stock. Based on these sights, they fear the Fed is sowing the seeds of another bubble.

Given all that went wrong, such concerns shouldn't be dismissed without examination—and the Fed is doing just that. "In light of the current low interest-rate environment," the central bank's chairman, Ben Bernanke, said last week, "we are watching particularly closely for instances of 'reaching for yield' and other forms of excessive risk taking."

The question is whether the Fed should do more than watchful waiting. It has three options:

One is to talk a lot about its anxieties and warn banks and investors to be cautious. A second is to target its new, untested regulatory and supervisory tools developed after the crisis at the most worrisome behavior; that's proving easier to say than do. And the third is to stop putting so much money into the system or even to raise interest rates.

The president of the Federal Reserve Bank of Minneapolis, Narayana Kocherlakota, recently framed the choice this way: Tightening the credit spigot "will definitely lead to lower employment and prices" and "may reduce the risk of a financial crisis—a crisis which could give rise to a much larger fall in employment and prices." (The italics are his.)

Imagine you're sitting at that big mahogany table at the Fed. You see clear signs of excess in a few corners of the financial market and steadily rising stock prices. You recognize that the stimulus of tax cuts and spending increases is gone, and spending cuts and tax increases are reducing the deficit quicker than expected, braking a slow-growing economy. You note that inflation is below your 2% target while unemployment is forecast to remain above 7% through mid-2014.

What would you do? If inflation were higher and unemployment much lower, the call would be easier: Tighten the credit spigot. But that's not the case. So you might talk more and louder about incipient financial excesses, explain how the Fed is monitoring them and how it might use its new regulatory muscle—and be very slow and gentle about withdrawing the monetary stimulus that has been sustaining the not-so-great recovery.

Which is exactly what Mr. Bernanke is doing.

I like your balanced approach to investing. We just have different proportions.

The "Fed" and Central Banking seem to be a common thread here and the drop in gold/silver can, in part, be attributed to Fed policy and the resultant low inflation rate. The Wall Street Journal had a good, easy-to-read article this past Wednesday:

WSJ Global Economics Editor David Wessel joins the News Hub with a look at what we know and what we don't know about central banks, easy money, asset purchases and bubbles.

The Dow Jones Industrial Average has risen 14% since the Federal Reserve launched a third round of bond buying in September.

The Stoxx Europe 600 index has climbed 22% since the president of the European Central Bank vowed in July to do "whatever it takes" to save the euro.

Japan's Nikkei has risen 22% since the Bank of Japan unveiled its big bond-buying initiative in April—and more than 50% since the election of a new government that campaigned on installing an aggressive central banker.

There were, of course, other drivers behind the stock-market gains. But there's little doubt that when central banks print lots of money (or hint they will), they push up stocks, bonds, houses and other assets. Indeed, that was part of the plan: Boost asset prices so businesses and consumers will spend more readily.

Did the central banks' efforts work? Did struggling economies get a lift? And has the Fed, which acted more forcefully than others, overdone it? Is it blowing another bubble already?

Taking the Fed as a case study, the short answers: Yes, it worked, though not as well as anyone hoped. And, no, the Fed hasn't overdone it yet, but that's worth worrying about.

There is plenty to criticize about the Bush-Obama-Bernanke response to the financial crisis and recession, but consider this: The combined one-two punch of fiscal and monetary policies has helped the U.S. economy expand for the past 20 quarters. Europe, which did less fiscal and less monetary stimulus, is mired in its second recession in a decade; its economy has been contracting for six quarters.

The Fed's moves to push mortgage rates down are helping home prices—and, lately, home building. And, at last, there are signs that rising stock and bond prices are doing more than helping companies refinance old debt and fattening rich Americans' brokerage accounts: A surge in initial public offerings is giving growing companies capital to expand. The strength of consumer spending despite stagnant wages reflects, in part, rising stock and house prices.

But … we know what can happen when rates are too low for too long and credit is too readily available: People and businesses borrow too much for their own good. Banks get into trouble. Investors unhappy with low yields on bank deposits or Treasury bonds look for higher returns in riskier assets, not always understanding the potential downside. Money seeps into poorly regulated crevices of the financial system like water that seeps into cracks in cliffs, then freezes, expands and causes a rock slide.

It's such memories that lead some thoughtful people who applauded the initial round of Fed bond buying to suggest the latest round was too much. They see the rapid growth of companies that rely on low short-term rates to borrow heavily, buy mortgages and pay big dividends. They see investors buying junk bonds at low rates at which only the U.S. Treasury could borrow not so long ago. They see small investors borrowing to buy stock. Based on these sights, they fear the Fed is sowing the seeds of another bubble.

Given all that went wrong, such concerns shouldn't be dismissed without examination—and the Fed is doing just that. "In light of the current low interest-rate environment," the central bank's chairman, Ben Bernanke, said last week, "we are watching particularly closely for instances of 'reaching for yield' and other forms of excessive risk taking."

The question is whether the Fed should do more than watchful waiting. It has three options:

One is to talk a lot about its anxieties and warn banks and investors to be cautious. A second is to target its new, untested regulatory and supervisory tools developed after the crisis at the most worrisome behavior; that's proving easier to say than do. And the third is to stop putting so much money into the system or even to raise interest rates.

The president of the Federal Reserve Bank of Minneapolis, Narayana Kocherlakota, recently framed the choice this way: Tightening the credit spigot "will definitely lead to lower employment and prices" and "may reduce the risk of a financial crisis—a crisis which could give rise to a much larger fall in employment and prices." (The italics are his.)

Imagine you're sitting at that big mahogany table at the Fed. You see clear signs of excess in a few corners of the financial market and steadily rising stock prices. You recognize that the stimulus of tax cuts and spending increases is gone, and spending cuts and tax increases are reducing the deficit quicker than expected, braking a slow-growing economy. You note that inflation is below your 2% target while unemployment is forecast to remain above 7% through mid-2014.

What would you do? If inflation were higher and unemployment much lower, the call would be easier: Tighten the credit spigot. But that's not the case. So you might talk more and louder about incipient financial excesses, explain how the Fed is monitoring them and how it might use its new regulatory muscle—and be very slow and gentle about withdrawing the monetary stimulus that has been sustaining the not-so-great recovery.

Which is exactly what Mr. Bernanke is doing.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 18, 2013 03:33PM |

Registered: 13 years ago Posts: 1,445 |

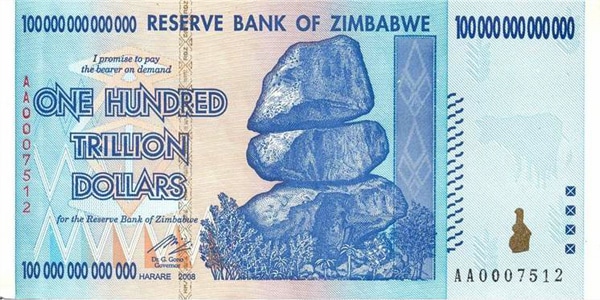

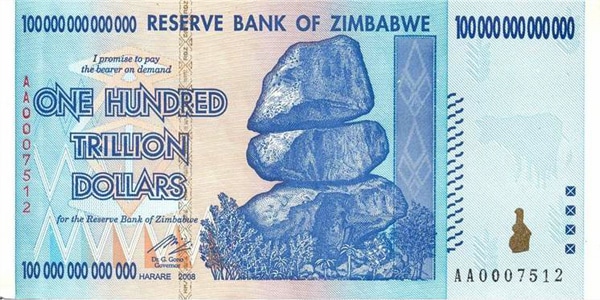

What we are witnessing in the US and Japan is the makings of hyperinflation. Look at these two obvious signs -

1. Governments are essentially printing money to buy back their bonds. Think about that.

2. The price of food and goods is starting to noticeably rise. Now, regarding that last one, you have to consider the shrinking size of packaged foods, which hides the true cost of the foods. When you factor in the actual inflation rate to be closer to 9.5%, things are looking dangerous. Don't worry, if things continue as they are now going, we will see sure signs of hyperinflation in the next few months, or should I say stronger signs.

Japan's stock market is now racing ahead, just like... Americas. Hmmmm, why? What have they done recently. Hint - It rhymes with Quantitative Sleazing. Put the puzzle together. Beyond that, you can see them smacking gold and silver paper markets and wonder why? Well, that is clear. In times of hyperinflation peoples put their money into other areas such as currencies and gold & silver. Interest rates are so low that people with money are afraid to put their devaluing money into low interest rate accounts - so they are putting money into stock markets now. See where this is going? An economy that is stagnant and a screaming stock market. How long you think this continues? Better yet, how long can it continue? I say till end of the year or there abouts but wouldn't be shocked to see it pop sooner. My biggest fear though, is that hyperinflation often signals war, the bloody kind.

Go-Bernanke / Go-Bankers are you listening?

Rover - Great idea, with each pay check just pick up something that won't be worthless. Silver/Gold at this point is not even an investment, it is survival against those criminals in suits and ties.

1. Governments are essentially printing money to buy back their bonds. Think about that.

2. The price of food and goods is starting to noticeably rise. Now, regarding that last one, you have to consider the shrinking size of packaged foods, which hides the true cost of the foods. When you factor in the actual inflation rate to be closer to 9.5%, things are looking dangerous. Don't worry, if things continue as they are now going, we will see sure signs of hyperinflation in the next few months, or should I say stronger signs.

Japan's stock market is now racing ahead, just like... Americas. Hmmmm, why? What have they done recently. Hint - It rhymes with Quantitative Sleazing. Put the puzzle together. Beyond that, you can see them smacking gold and silver paper markets and wonder why? Well, that is clear. In times of hyperinflation peoples put their money into other areas such as currencies and gold & silver. Interest rates are so low that people with money are afraid to put their devaluing money into low interest rate accounts - so they are putting money into stock markets now. See where this is going? An economy that is stagnant and a screaming stock market. How long you think this continues? Better yet, how long can it continue? I say till end of the year or there abouts but wouldn't be shocked to see it pop sooner. My biggest fear though, is that hyperinflation often signals war, the bloody kind.

Go-Bernanke / Go-Bankers are you listening?

Rover - Great idea, with each pay check just pick up something that won't be worthless. Silver/Gold at this point is not even an investment, it is survival against those criminals in suits and ties.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 18, 2013 07:15PM |

Registered: 15 years ago Posts: 57 |

It's amazing how naive some people can be. The US went through this same scenario about 30-40 years ago, and not many Americans have learned from it.

Think about this, EVERY paper currency that has existed printed by man, without being backed by something of value has ALWAYS went to ZERO value. It's called greed. You really don't have to be super intelligent to figure out where the dollar is headed.

Think about this, EVERY paper currency that has existed printed by man, without being backed by something of value has ALWAYS went to ZERO value. It's called greed. You really don't have to be super intelligent to figure out where the dollar is headed.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 18, 2013 10:36PM |

Registered: 14 years ago Posts: 1,135 |

I stopped at a local coin shop today, to pick up some silver for my graduate son. I asked him why the sparce silver inventory? He said he cannot get product from his suppliers. It just goes to show the comex prices are not determined by supply/ demand. If the supply stays this tight, and when the price breaks upward, it should move quite fast.

In our life time we have never run into any major economic messes in this country. Its easy to have a false sense of security, that nothing bad will ever happen. But, there are huge storm clouds on the horizon. Better to be prepared, than not..... just in case the economic experts are correct.

In our life time we have never run into any major economic messes in this country. Its easy to have a false sense of security, that nothing bad will ever happen. But, there are huge storm clouds on the horizon. Better to be prepared, than not..... just in case the economic experts are correct.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 19, 2013 02:56PM |

Registered: 15 years ago Posts: 1,852 |

Albert, I am sorry that you are suffering under the hyperinflation seen in Zimbabwe today. if you were so fortunate to live in the USA you'd have the Fed [www.federalreserve.gov] covering your back; the European Central Bank [www.ecb.int] is charged with similar safeguards if you lived in Europe.

I'll worry about hyperinflation when Obama's UN troops take away my guns...

I'll worry about hyperinflation when Obama's UN troops take away my guns...

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 19, 2013 04:08PM |

Registered: 13 years ago Posts: 1,445 |

go-rebels Wrote:

-------------------------------------------------------

> Albert, I am sorry that you are suffering under

> the hyperinflation seen in Zimbabwe today. if

> you were so fortunate to live in the USA you'd

> have the Fed [www.federalreserve.gov]

> covering your back; the European Central Bank

> [www.ecb.int] is

> charged with similar safeguards if you lived in

> Europe.

>

> I'll worry about hyperinflation when Obama's UN

> troops take away my guns...

Try to look at the information being presented and less about the people behind it - not to mention attacking those people personally (Though no offense taken.)

It is really difficult to have a talk with you when you look at so few points in an argument and then make jokes about things. Which one do you want? Is this about people or ideas or?

-------------------------------------------------------

> Albert, I am sorry that you are suffering under

> the hyperinflation seen in Zimbabwe today. if

> you were so fortunate to live in the USA you'd

> have the Fed [www.federalreserve.gov]

> covering your back; the European Central Bank

> [www.ecb.int] is

> charged with similar safeguards if you lived in

> Europe.

>

> I'll worry about hyperinflation when Obama's UN

> troops take away my guns...

Try to look at the information being presented and less about the people behind it - not to mention attacking those people personally (Though no offense taken.)

It is really difficult to have a talk with you when you look at so few points in an argument and then make jokes about things. Which one do you want? Is this about people or ideas or?

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 19, 2013 04:39PM |

Registered: 12 years ago Posts: 2,225 |

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 19, 2013 04:47PM |

Registered: 14 years ago Posts: 1,229 |

Interesting article. Contracts settled in cash. May or may not be a big deal, but did a lot of these investors assume their contracts would be settled in physical delivery ? They will now be settled in cash, and they don't even know what the price will be. Question is, can this be considered a 'default' ?

[www.scmp.com]

[www.scmp.com]

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 19, 2013 04:57PM |

Registered: 13 years ago Posts: 1,445 |

therover61 Wrote:

-------------------------------------------------------

> Interesting article. Contracts settled in cash.

> May or may not be a big deal, but did a lot of

> these investors assume their contracts would be

> settled in physical delivery ? They will now be

> settled in cash, and they don't even know what the

> price will be. Question is, can this be considered

> a 'default' ?

>

> [www.scmp.com]

> -mercantile-exchange-closes-its-doors

Can this be considered a default?

By definition what is a default? [www.investopedia.com]

1. The failure to promptly pay interest or principal when due. Default occurs when a debtor is unable to meet the legal obligation of debt repayment. Borrowers may default when they are unable to make the required payment or are unwilling to honor the debt.

2. The failure to perform on a futures contract as required by an exchange.

So, people aren't losing their money, but are not being delivered what they paid for. Seems like by #2 above it is a default.

They think it is a default here: [investmentwatchblog.com] and [www.godlikeproductions.com] sounds like Max Kaisser thinks so [maxkeiser.com] and the list goes on.

This is pretty big news, again,

Albert

-------------------------------------------------------

> Interesting article. Contracts settled in cash.

> May or may not be a big deal, but did a lot of

> these investors assume their contracts would be

> settled in physical delivery ? They will now be

> settled in cash, and they don't even know what the

> price will be. Question is, can this be considered

> a 'default' ?

>

> [www.scmp.com]

> -mercantile-exchange-closes-its-doors

Can this be considered a default?

By definition what is a default? [www.investopedia.com]

1. The failure to promptly pay interest or principal when due. Default occurs when a debtor is unable to meet the legal obligation of debt repayment. Borrowers may default when they are unable to make the required payment or are unwilling to honor the debt.

2. The failure to perform on a futures contract as required by an exchange.

So, people aren't losing their money, but are not being delivered what they paid for. Seems like by #2 above it is a default.

They think it is a default here: [investmentwatchblog.com] and [www.godlikeproductions.com] sounds like Max Kaisser thinks so [maxkeiser.com] and the list goes on.

This is pretty big news, again,

Albert

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 19, 2013 06:44PM |

Registered: 14 years ago Posts: 1,229 |

Albert,

Reason I had stated that and put the word default into quotes was because of the numerous definitions and interpretations of it. Some may say since these people were paid in cash (whatever currency they settle in), it was not a default. But to me, if I was under the impression that I would be settled in what I wanted (being physical gold), and the prospectus stated such ( not sure what the fine print read on that !), then I would say it was a default.

This will be a back page story, and non event, in the eyes of the MSM but it may be the start of something and possibly more stories written about how/why these exchanges are hosing their clients.

One still has to ask why central banks are accumulating gold in its physical state as the paper price continues to drop. Same with China, Russia, India and others in the East. Are they stupid or smart ?

It will be interesting to see what the PM's do on the open in the Asian market and how it follows through into London and US come Monday. My guess is more of the same....buying in Asia, smack down on the London fix and into the US market.

Reason I had stated that and put the word default into quotes was because of the numerous definitions and interpretations of it. Some may say since these people were paid in cash (whatever currency they settle in), it was not a default. But to me, if I was under the impression that I would be settled in what I wanted (being physical gold), and the prospectus stated such ( not sure what the fine print read on that !), then I would say it was a default.

This will be a back page story, and non event, in the eyes of the MSM but it may be the start of something and possibly more stories written about how/why these exchanges are hosing their clients.

One still has to ask why central banks are accumulating gold in its physical state as the paper price continues to drop. Same with China, Russia, India and others in the East. Are they stupid or smart ?

It will be interesting to see what the PM's do on the open in the Asian market and how it follows through into London and US come Monday. My guess is more of the same....buying in Asia, smack down on the London fix and into the US market.

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 19, 2013 08:20PM |

Registered: 13 years ago Posts: 1,445 |

Rover - All it means really is the same thing is happening in China that is happening in America - The exchanges are not honoring physical contracts with gold, they are "settling" for cash. But to many of us here, it is no shock. It is the predictable outcome of what GATA.org has been telling us for years. So, 15 or so years ago when I was first privied to this information, what we see happening now could have been foresaw as one of the likely outcome. The other would be a sky high gold and silver price of course. (But that is still on the table

Agree about the back page story.

The banks need the gold to create their next currency. eheheh - Kidding, I hope...

Agree about the back page story.

The banks need the gold to create their next currency. eheheh - Kidding, I hope...

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 23, 2013 10:30AM |

Registered: 13 years ago Posts: 277 |

|

Re: $$$$Any Speculation Why Gold & Silver Is Dropping?$$$$ May 23, 2013 10:33AM |

Registered: 13 years ago Posts: 277 |

The stock market bubble isn't what should concern people. It's the unprecedented 30 year bull market in bonds, coupled with an artificially maintained low yield, that should have people concerned. If that bubble goes look out.

Every 1% rise in interest rates increases our government's debt carrying cost by a couple hundred billion dollars.

We're already in the red as it is now with government spending. In other words, every 1% rise is another couple hundred billion we have to borrow just to pay our debt. Compounding interest is a bitch. And that's ONLY the public debt. Add to that the private debt and, ouch. When this bond bubble finally blows, it's going to hurt.

Printing money comes with consequences.

This is really going to go well for the gas prices for this holiday weekend.

Every 1% rise in interest rates increases our government's debt carrying cost by a couple hundred billion dollars.

We're already in the red as it is now with government spending. In other words, every 1% rise is another couple hundred billion we have to borrow just to pay our debt. Compounding interest is a bitch. And that's ONLY the public debt. Add to that the private debt and, ouch. When this bond bubble finally blows, it's going to hurt.

Printing money comes with consequences.

This is really going to go well for the gas prices for this holiday weekend.